The crypto markets have accepted the depegging of UST and the subsequent downward spiral of LUNA, both of which impacted the price of Bitcoin and the entire digital asset spectrum. According to a son rapor by the Glassnode team, the Bitcoin market has been trading lower for eight weeks, making it the ‘longest continuous series of red weekly candles in history.’

Even Ethereum, the most popular altcoin, painted a similar picture. Bearish fluctuations damage returns and profit margins directly or indirectly.

To make matters worse, derivative markets forecast shows more declines in the coming three to six months.

Derivative Markets Hint At More Pain For Bitcoin

According to derivative markets, the prognosis for the next three to six months remains fearful of further fall. On-chain, the report stated that blockspace demand for Ethereum and Bitcoin has dropped to multi-year lows, and the rate of ETH burning via EIP1559 has reached an all-time low.

Glassnode calculated that the demand side will continue to face headwinds due to poor price performance, uncertain derivatives pricing, and extremely low demand for block-space on both Bitcoin and Ethereum.

Rapor şunları açıklıyor:

Looking on-chain, we can see that both Ethereum and Bitcoin blockspace demand has fallen to multi-year lows, and the rate of burning of ETH via EIP1559 is now at an all-time-low.

Düşük fiyat performansı, korkutucu türev fiyatları ve hem Bitcoin hem de Ethereum'da blok alanı talebinin son derece cansız olmasıyla birleştiğinde, talep tarafının ters rüzgarlar görmeye devam edeceği sonucunu çıkarabiliriz.

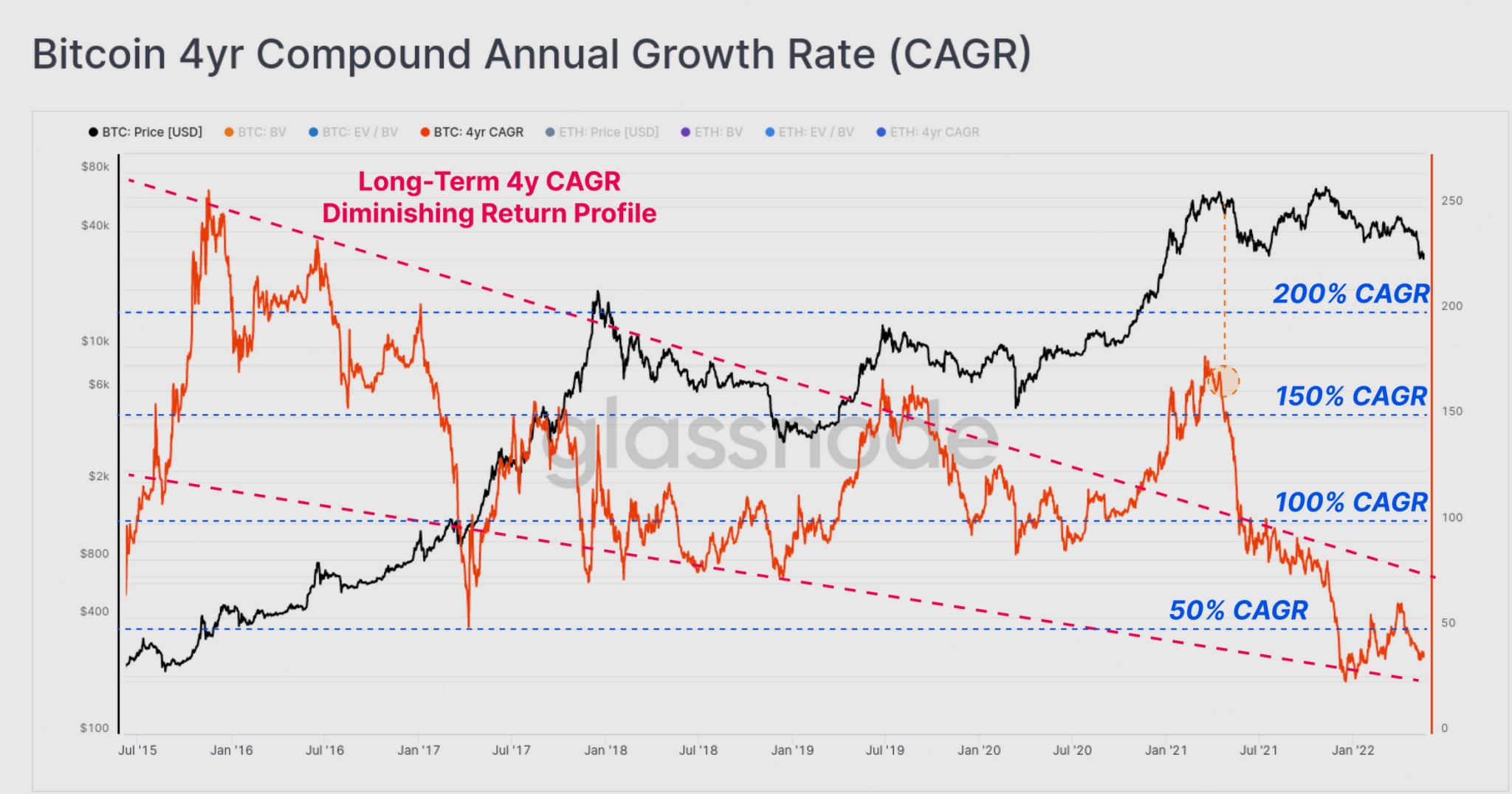

Both Bitcoin and Ethereum’s price performance over the last 12 months has been disappointing. Long-term CAGR rates for Bitcoin and Ethereum have been impacted as a result of this.

Kaynak: Glassnode

BTC, the largest cryptocurrency, moved in a roughly 4-year bull/bear cycle, which was frequently accompanied with halving events. When looking at long-term returns, the CAGR has dropped from almost 200 percent in 2015 to less than 50 percent as of this writing.

İlgili Okuma | Yeni Veriler Çin'in Hala Küresel Bitcoin Madenciliği Hash Oranının %21'ini Kontrol Ettiğini Gösteriyor

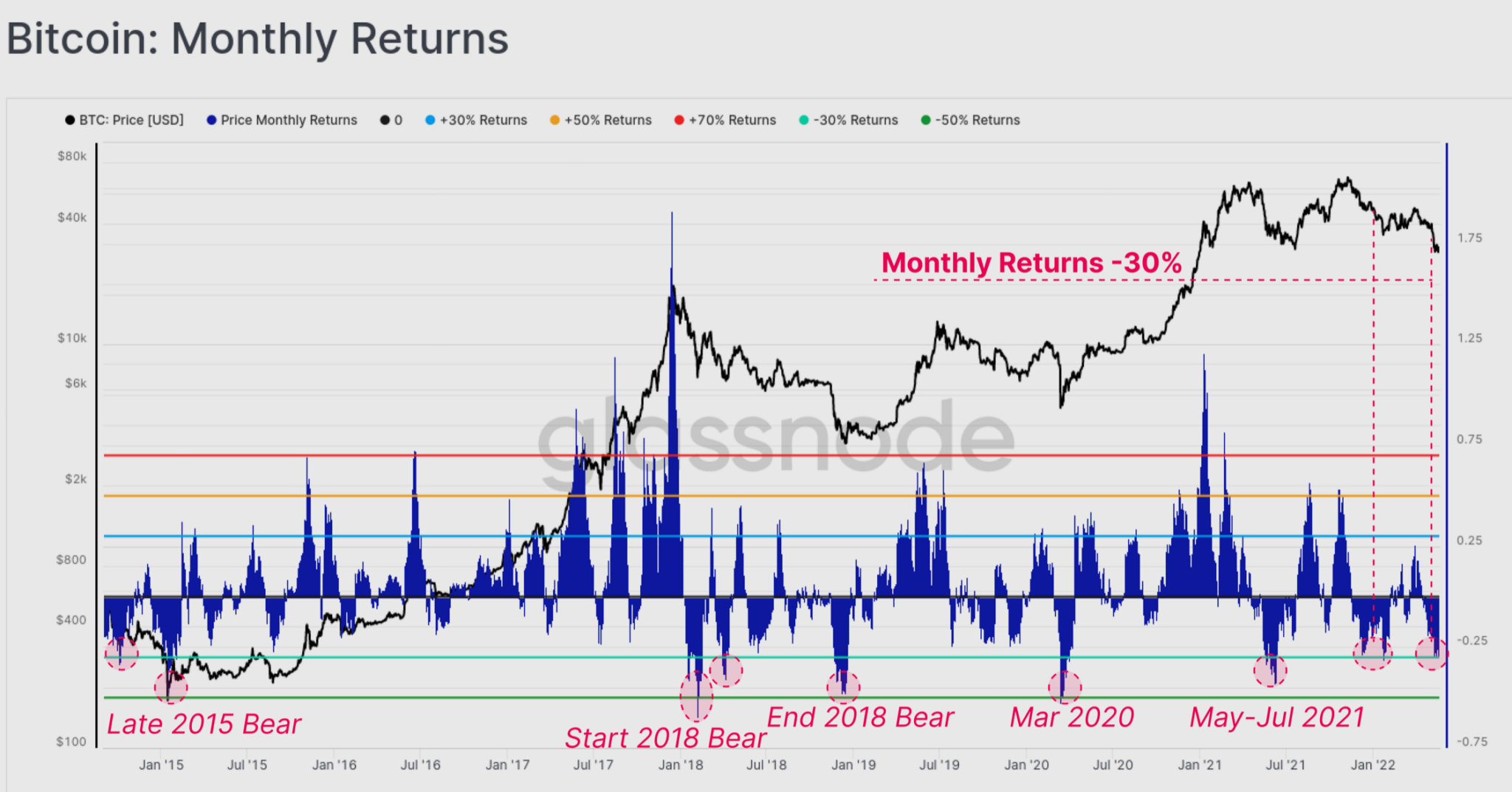

Furthermore, Bitcoin had a negative 30% return over the short term, implying that it corrected by 1% every day on average. This negative return for Bitcoin is very similar to prior bear market cycles.

Kaynak: Glassnode

When it comes to ETH, the altcoin performed far worse than BTC. Ethereum’s monthly return profile revealed a depressing picture of -34.9 percent. Ethereum likewise appears to be seeing diminishing rewards in the long run.

Furthermore, during the previous 12 months, the 4-year CAGR for both assets has dropped from 100% to only 36% for BTC. Also, ETH is up 28 percent per year, emphasizing the severity of this bear.

To make matters worse, the derivative market warned of future market declines. Near-term uncertainty and downside risk continue to be priced into options markets, particularly over the next three to six months. In reality, during the market sell-off last week, implied volatility increased significantly.

Toplam kripto piyasası değeri 1.2 Trilyon Dolar seviyesinde bulunuyor. Kaynak: TradingView

The Glassnode analysis concluded by stating that the present bear market has taken its toll on crypto traders and investors. Furthermore, the Glassnode team emphasized that downturn markets frequently worsen before improving. However, ‘bear markets do have a tendency of ending’ and ‘bear markets author the bull that follows,’ so there is some light at the end of the tunnel.

İlgili Okuma | TA: Bitcoin Price Stuck In Key Range, Why Dips Might Be Limited

Featured image from iStockPhoto, Charts from Glassnode, and TradingView.com

Source: https://www.newsbtc.com/news/bitcoin/investors-may-expect-downside-for-bitcoin-and-ethereum-market-for-the-next-3-months/