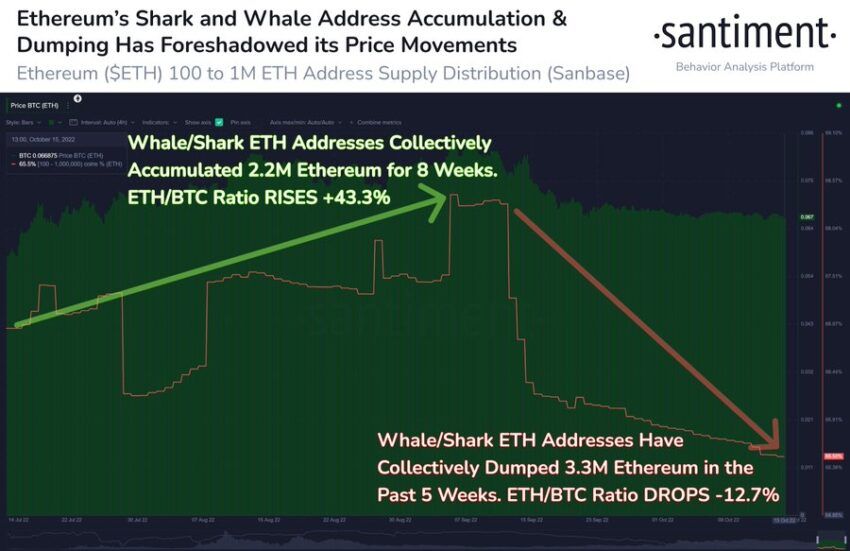

Ethereum (ETH) shark and whale address holdings have decreased by over 3 million ETH in the last five weeks, suggesting that the biggest holders are dumping, according to Santiment data.

According to the blockchain analytics company, sharks and whales have terk $4.2 billion worth of Ethereum. Dumping has played a role in influencing the value of ETH versus Bitcoin periyod boyunca.

Before the dumping started, ETH whales and sharks accumulated 2.2 million ETH, causing ETH/BTC ratio to increase by 43.3%. However, since the massive sales began in the last five weeks, there has been a 12.7% drop in ETH/BTC ratio.

Ethereum Whales Face Price Manipulation Allegations

Earlier in the month, a CryptoQuant analyst yazdı that whales were manipulating the market. According to the analyst, ETH whales were gönderme their holdings to exchanges to raise the value of ETH and sell it at a higher price.

However, whatever price manipulation might have happened is clearly not enough to influence the long-term market. The current selling activity of the whales and sharks appeared to prevent the asset from rallying.

Ethereum Price Remains Steady as ETH Becomes Deflationary

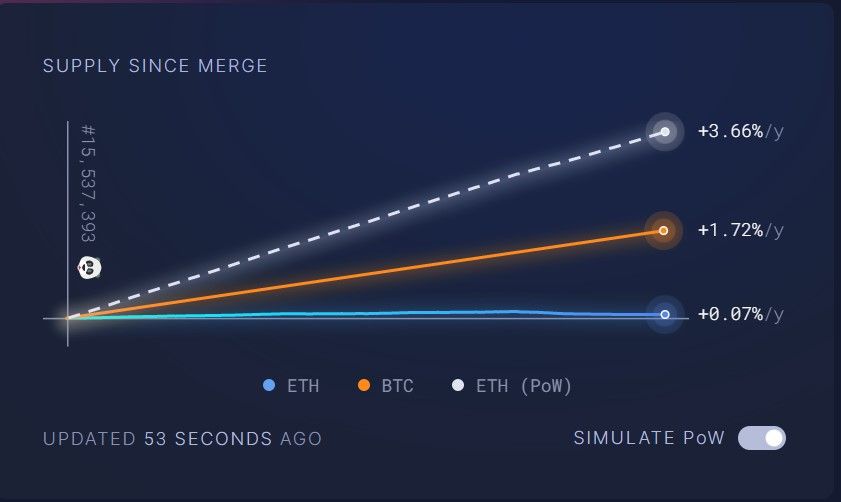

Available data from ultrasound.money shows that Ethereum has become deflationary for the first time since it completed its migration to a kanıtı hissesini ağ.

The deflation could be linked to the launch of a new crypto project, XEN crypto, which required minting and briefly artmış activity on the network. According to the data, XEN Crypto alone is responsible for burning 3527 ETH, which is over two times the amount burned by leading Defi protocol Uniswap.

As of press time, 6,850 ETH has hit the market since Birleştirme. If the asset were still running a işin kanıtı consensus mechanism, it would have added over 370,000 ETH.

ETH Price Prediction: Still Struggling to push above $1,500

The ETH price has struggled since it completed the merge. The asset’s value has decreased by more than 9% in the last 30 days. During this period, Ethereum’s price value went from $1,600 to $1,386. For context, BTC only dropped by 3.14% over the same time.

BeInCrypto'nun son hali için Bitcoin (BTC) analizi, buraya Tıkla

Feragatname

Web sitemizde yer alan tüm bilgiler iyi niyetle ve yalnızca genel bilgi amaçlı yayınlanmaktadır. Okuyucunun web sitemizde bulunan bilgilere göre yapacağı herhangi bir eylem kesinlikle kendi sorumluluğundadır.

Source: https://beincrypto.com/ethereum-whale-and-shark-addresses-offload-as-eth-price-struggles/