TL; DR Dağılımı

- Polkadot fiyat analizi 5.70 dolara doğru bir yükselişe işaret ediyor

- En yakın destek seviyesi 5.27 $ 'dır

- DOT, 5.46 $ işaretinde dirençle karşı karşıya

The Polkadot price analysis shows that the DOT price action has recovered back to the $5.40 mark as the bulls charge above.

The broader cryptocurrency market observed a positive market sentiment over the last 24 hours as most major cryptocurrencies recorded negative price movements. Major players include ETH and XRP, recording an 6.90, and a 4.26 percent incline, respectively.

Polkadot fiyat analizi: DOT 5.40 dolara geri döndü

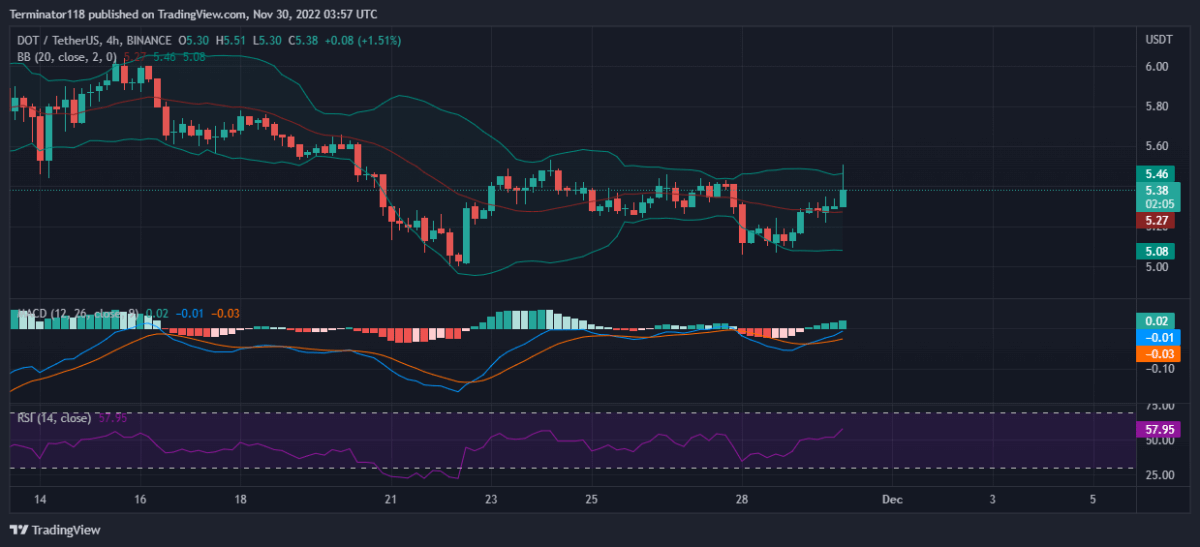

MACD şu anda histogramın yeşil rengiyle ifade edildiği gibi yükseliş eğiliminde. Ancak gösterge, histogramın düşük yüksekliğinde ifade edildiği gibi düşük yükseliş momentumunu gösteriyor. Öte yandan, histogramın daha koyu tonu artan bir yükseliş momentumuna işaret ediyor ve fiyatın yukarı doğru yöneldiğini gösteriyor.

The EMAs are currently trading close to the mean position as net price movement over the last ten days remains low. However, as the two EMAs diverge and move upwards, the buying activity is bound to rise. Currently, the 12-EMA is leading the run toward the mean line suggesting an increasing bullish activity in the markets.

The RSI has been trading in the neutral region for some time but it was trading below the mean level for the past few days. Now, the index has risen up and continues moving upwards as it trades at 57.95 at press time. The indicator issues no signals while the upwards slope shows bullish pressure.

The Bollinger Bands were narrow until yesterday but the sharp price movement from the $5.07 to the current $ 5.40 seviyesi has caused them to expand. At press time, the indicator’s bottom line provides support at $5.08 while the upper limit presents a resistance level at $5.46.

DOT/USDT için teknik analizler

Genel olarak 4 saatlik Polkadot fiyatı analiz, boğaları destekleyen 13 ana teknik göstergeden 26'ü ile bir satın alma sinyali veriyor. Öte yandan, göstergelerden dördü, son saatlerde düşük düşüş eğilimi gösteren ayıları destekliyor. Aynı zamanda, dokuz gösterge çitin üzerinde oturuyor ve piyasanın hiçbir tarafını desteklemiyor.

The 24-hour Polkadot price analysis does not share this sentiment and issues a sell signal with 11 indicators suggesting a downward movement against five indicators suggesting an upwards movement. The analysis shows bearish dominance across the mid-term charts while low buying pressure for the asset across the same timeframe. Meanwhile, ten indicators remain neutral and do not issue any signals at press time

Polkadot fiyat analizinden ne beklenir?

The Polkadot price analysis shows that the bearish pressure that caused the price to fall to $5.00 has mostly evaporated as the bulls are trying to make another attempt at the $5.50 level

Traders should expect DOT to move up toward the $5.50 mark where the key resistance lies. Traders should expect a bullish breakout to the $5.70 region as the mid-term technicals show a shift towards a bullish market. However, in case of a rejection, the price can be expected to drop to the $5.00 level continuing the consolidation.

Kaynak: https://www.cryptopolitan.com/polkadot-price-analysis-2022-11-30/