- Lido Finance’s LDO is now available on Coinbase.

- Will this development trigger an influx of new demand for LDO?

Lido Finans and its native token LDO are still relatively young in the crypto market. This means there is still a lot of untapped potential, especially now that it has established itself as one of the top staking platforms. Its latest announcement may help it actualize its adoption goals.

Okumak LDO’s price prediction 2023-2014

Coinbase, one of the largest regulated crypto exchanges in the U.S. has announced its support for the Lido DAO. According to the announcement, users can now access YAPARIM through Coinbase.

This means users can buy the asset on the exchange and stake it on Lido through the Ethereum network. The network also warned users against transferring the asset through networks other than Ethereum (ERC20).

Coinbase, Ethereum ağında (ERC-20 belirteci) Lido DAO (LDO) desteği ekleyecek. Bu varlığı diğer ağlar üzerinden göndermeyin, aksi takdirde paranız kaybolabilir. Bu varlık için gelen transferler şu adreste mevcuttur: @Coinbase & @CoinbaseExch ticaretin desteklendiği bölgelerde.

— Coinbase Varlıkları (@CoinbaseAssets) 16 Kasım 2022

Coinbase also confirmed plans to make the token accessible for trading through the LDO/USD trading pair. However, the trading pair will be rolled out in phases and may not be available in some jurisdictions.

What does the launch mean for LDO in terms of demand?

Coinbase listings are usually considered high-profile and often have a positive effect on cryptocurrencies. This is because Coinbase is a regulated cryptocurrency exchange that operates in the United States. A listing here provides access to millions of traders on the platform and this may boost the crypto’s adoption rate.

If this ends up being the case for LDO, then we will likely see a surge in its market cap as new buyers would pour in from Coinbase.

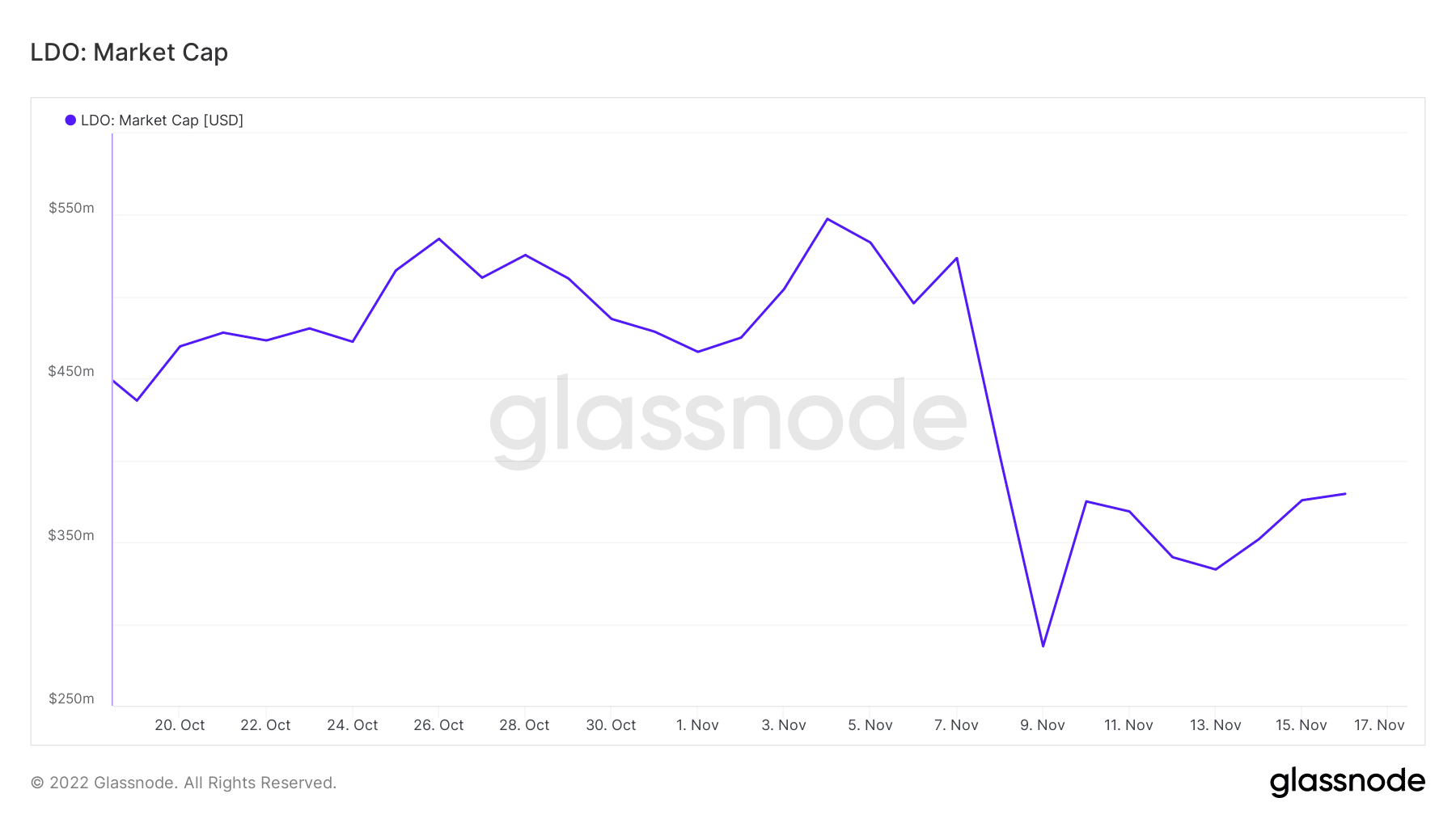

That said, LDO’s market cap took a hit last week, dropping from as high as $547.7 million to $286.4 million, at its current monthly low. It has, however, embarked on a toparlanma rallisi in the last few days and was at $379.6 million at press time.

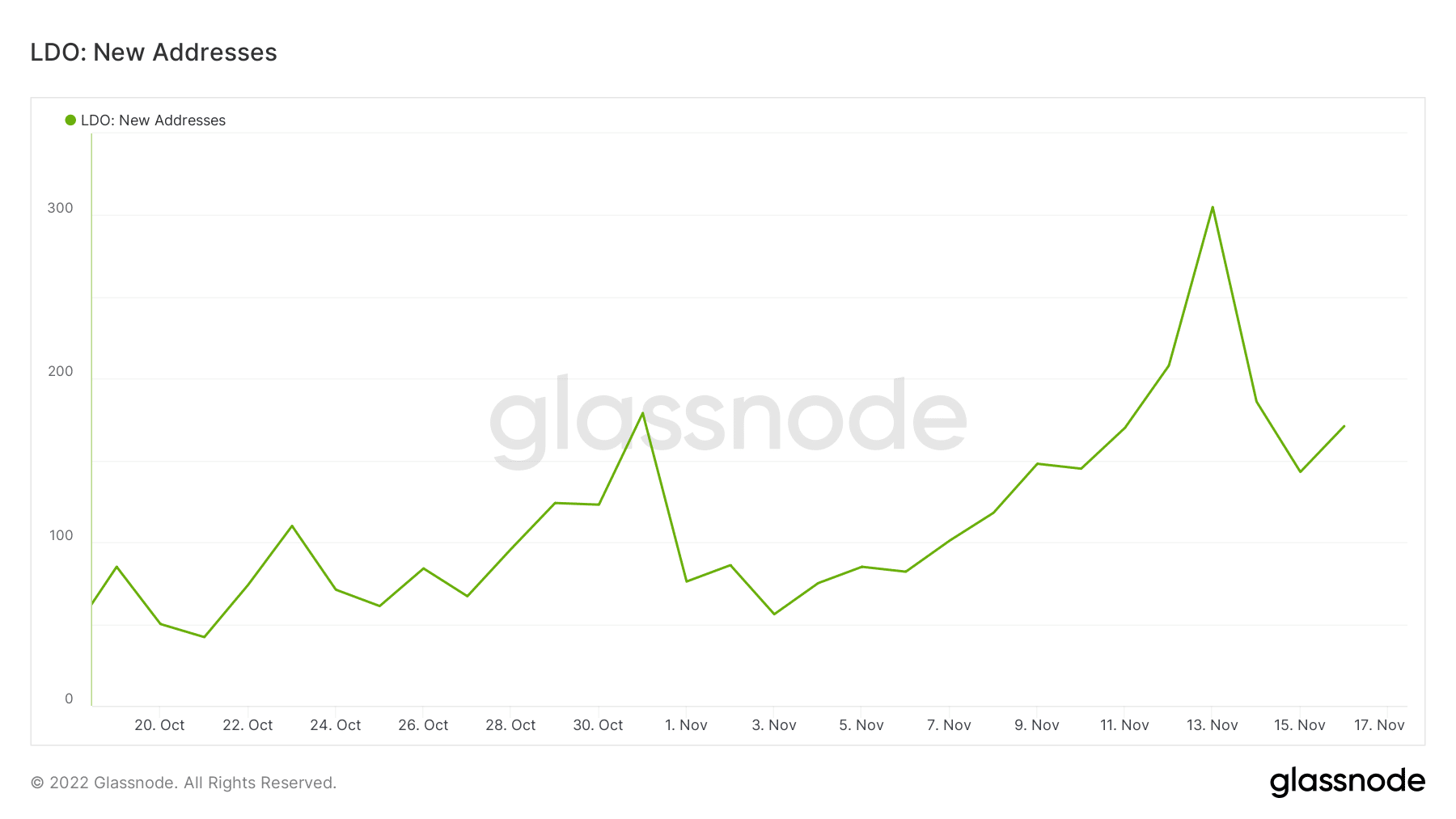

The current expectation is that the latest support from Coinbase might open up access to new buyers. Investors should thus look out for a potential increase in the number of new addresses in the next few days.

Interestingly, LDO’s new addresses have been growing even during last week’s crash. However, we did observe a drop in new addresses from 13 November.

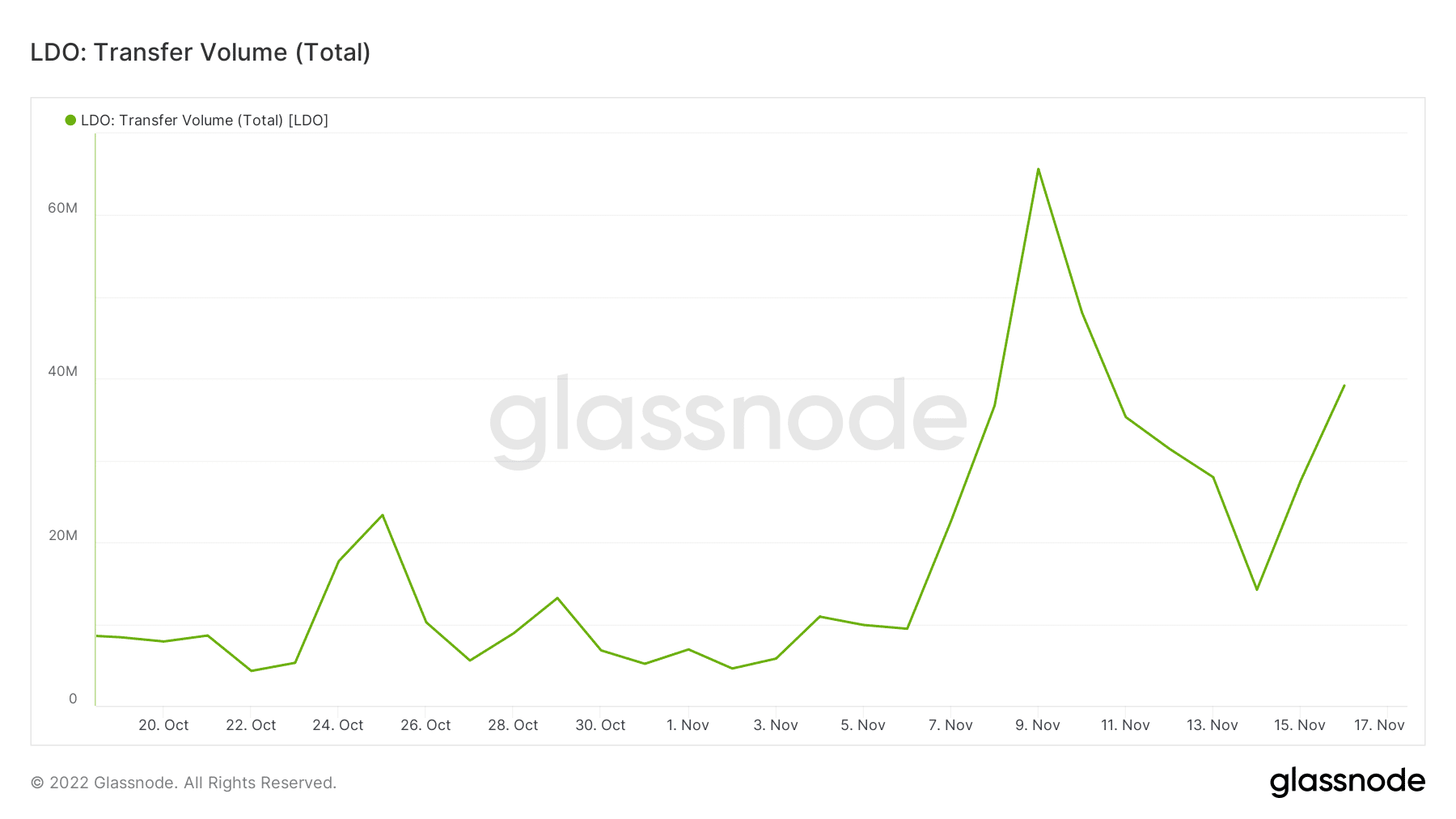

The new addresses metric indicates a recovery in the last two days. If things go as expected with Coinbase, then new addresses might spike, potentially to new monthly highs. In this regard, the transfer volume is also expected to increase. It was on a sharp uptick prior to the crash, after which it slowed down.

Furthermore, LDO’s transfer volume recovered slightly in the last two days. We might have some more upside if LDO demand kicks into high gear. Such an outcome would likely favor the price action. A look at LDO’s latest price action confirms some upside as it attempts to escape its lower range.

Despite the upside, low talep means it has not really managed to pull off a significant rally. Nevertheless, that might change if the Coinbase development will yield strong demand for LDO.

Source: https://ambcrypto.com/lido-daos-ldo-officially-launches-on-coinbase-what-this-means-for-investors/