Despite high weekly gains, the MATİC price has flatlined on the daily chart. On-chain metrics suggest that bears could take control from here.

After the MATIC price charted notable early December gains, investor and trader umma for the asset heightened. MATIC is currently in the tenth-ranked spot in terms of market cap and was showing a strong 8.5% gain in the past seven days. But can it keep the good times going?

MATIC Network Growth Drops

Daily active addresses and new MATIC addresses have both been falling. New addresses dropped by 15.94%, while active addresses saw a 10.69% pullback in the last week.

Between Nov. 27 and Dec. 1, the daily active address metric saw sustained growth alongside the MATIC price rise.

However, they also started to fall in tandem with prices from Dec. 1 onwards. A drop in active addresses usually signals lower market activity as bullish anticipations fade.

Network growth for MATIC is also dipping. combined with falling network growth, this doesn’t paint a very optimistic outlook for the price.

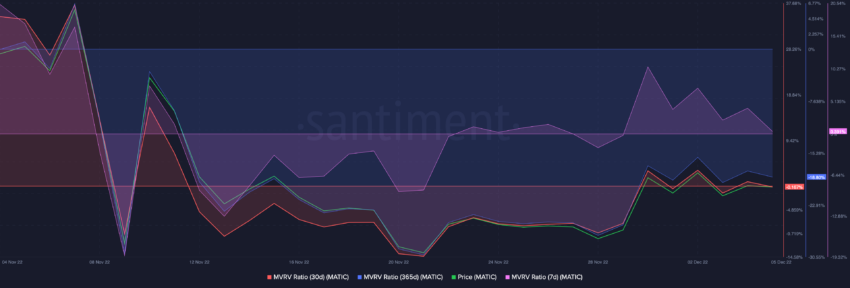

In addition, the 7-day MVRV for MATIC is heading in the negative zone. If the MATIC price continues to drop, short-term holders will be back at a loss. The 30-day and 365-day MVRV for MATIC was also in the negative, meaning that even long-term holders were back underwater.

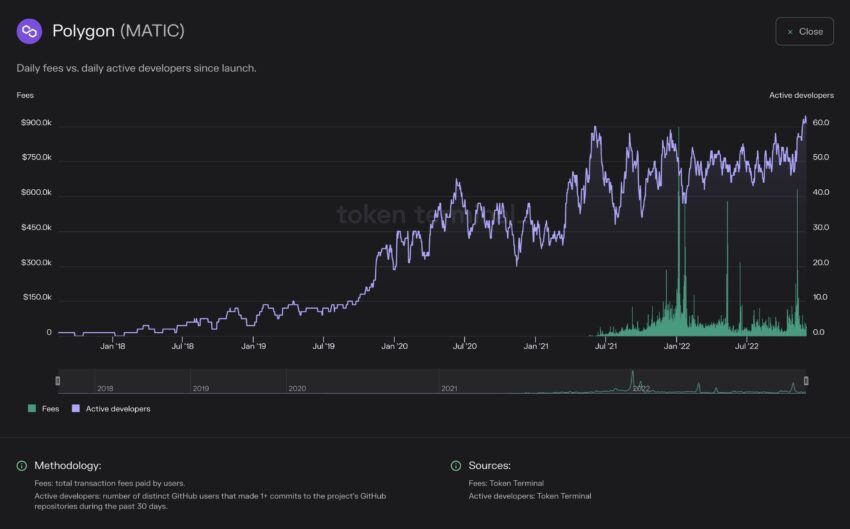

Developers Rowing the Polygon Boat

Despite weak on-chain metrics, Polygon’s active developer count has continued to grow.

Polygon also did well in terms of daily active users in the web3 space, securing the second spot following BNB Chain. Polygon had a daily active user count of around 412,430.

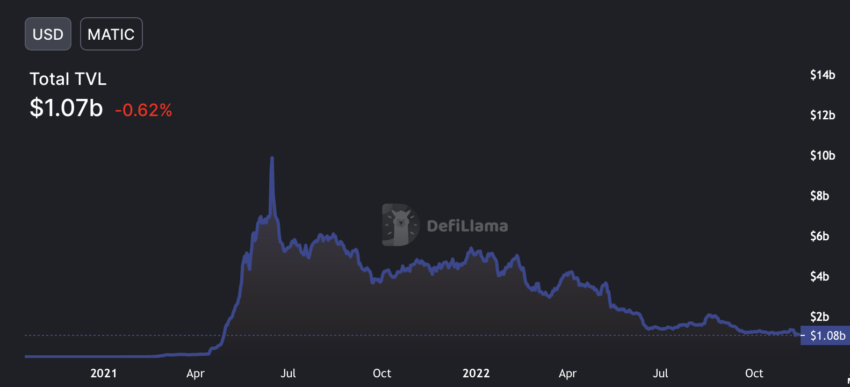

However, the total value locked (TVL) in Polygon Defi has continued to drop. Polygon TVL fell from an all-time high of $49.89 billion in June 2021 to a low of just over $1 billion at press time.

With its DeFi facet looking like a ghost town and sinking active addresses, the MATIC price could largely rely on retail euphoria and short-term uçuculuk if it’s to gain ground.

Sorumluluk Reddi: BeInCrypto, doğru ve güncel bilgiler sağlamaya çalışır, ancak eksik bilgilerden veya yanlış bilgilerden sorumlu olmayacaktır. Bu bilgilerden herhangi birini riski size ait olmak üzere kullanmanız gerektiğini kabul ediyor ve anlıyorsunuz. Kripto para birimleri oldukça değişken finansal varlıklardır, bu nedenle araştırma yapın ve kendi finansal kararlarınızı verin.

Feragatname

BeinCrypto, doğru ve güncel bilgiler sağlamaya çalışır, ancak eksik bilgilerden veya yanlış bilgilerden sorumlu olmayacaktır. Bu bilgilerden herhangi birini riski size ait olacak şekilde kullanmanız gerektiğini kabul ediyor ve kabul ediyorsunuz. Kripto para birimleri oldukça değişken finansal varlıklardır, bu nedenle araştırma yapın ve kendi finansal kararlarınızı verin.

Source: https://beincrypto.com/polygon-network-growth-slumps-where-will-matic-price-go/