Tanım

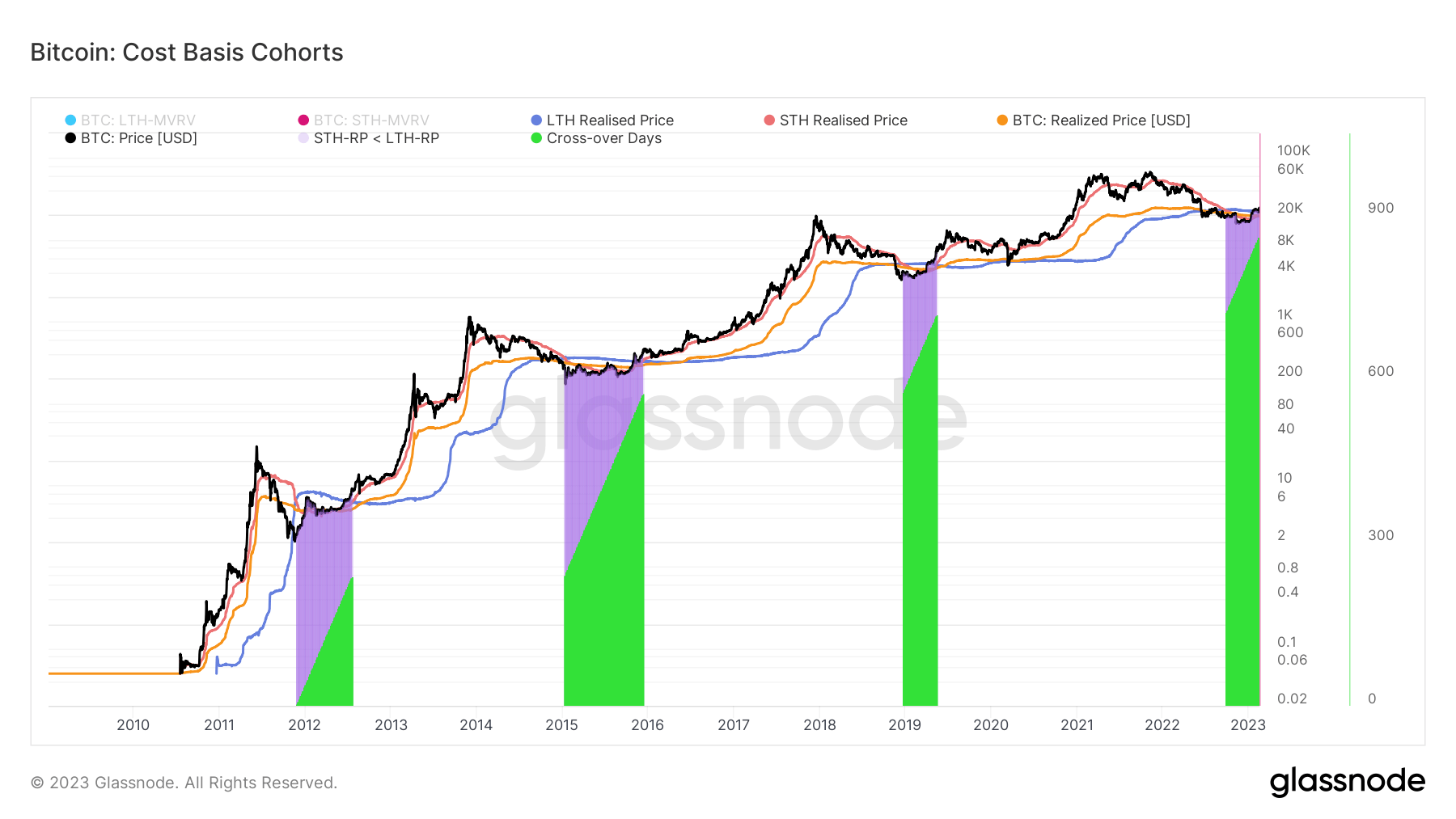

Realized Price reflects the aggregate price when each coin was last spent on-chain. Using Short- and Long-Term Holder (STH, LTH) cohorts, we can calculate the realized price to reflect the aggregate cost basis for each group.

Hızlı Çekim

- During later-stage bear markets, LTH cost basis is greater than STH cost basis, which is currently occurring.

- LTH cost basis is $22,240 while STH cost basis is $19,391.

- The four periods where the LTH cost basis is higher than the STH cost basis is highlighted with green and purple indicator.

- The total cross-over days is 864 days; this is broken down in each bear market by;

The 2012 bear market: 239 days

The 2015 bear market: 334 days

The 2019 bear market: 145 days

The 2022 bear market: 146 days

Sonrası Kısa vadeli elde tutma maliyeti bazı 146 gün boyunca uzun vadeli elde tutma maliyeti tabanının altında kaldı İlk çıktı CryptoSlate.

Source: https://cryptoslate.com/insights/short-term-holder-cost-basis-has-been-below-long-term-holder-cost-basis-for-146-days/